75% Canada Emergency Wage Subsidy Updates

On April 11, 2020, the 75% wage subsidy (the “subsidy” or “CEWS”) received royal assent and is now law. The practical application of the subsidy has left many employers scratching their heads. Here are some answers to some of the frequently asked questions:

The criteria have been further expanded to include employers:

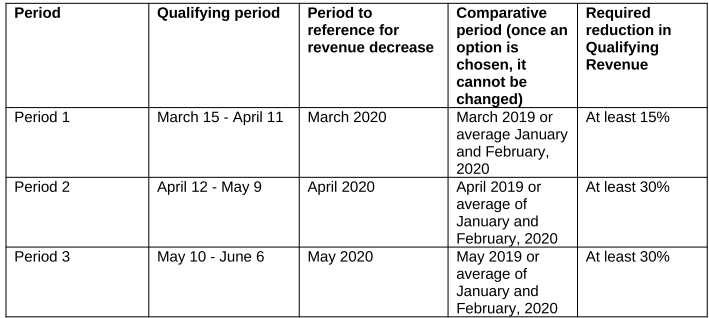

If you qualify in Period 1, you are deemed to meet the condition in the following period, however the required reduction in revenue must be met for each qualifying period.

You can use the cash or accrual method, but you must be consistent throughout the duration of the CEWS program.

You can elect to consolidate revenue across a group of companies, but if you elect this method, you cannot apply consolidation selectively, it must be across all companies.

The 75% subsidy is cash paid by the government to eligible employers, rather than a reduction of calculated payroll remittances.

Those eligible for both subsidies would claim the 10% subsidy, and then reduce amounts eligible under the 75% subsidy.

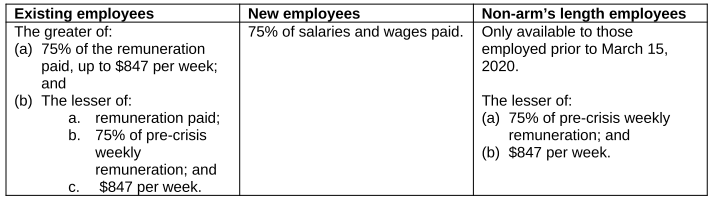

The amount of the subsidy will vary depending on whether the employee was employed prior to March 15, 2020 and whether the employee is at arm’s length.

In all cases, the subsidy is capped at $847 per week per eligible employee.

The subsidy is not available for those employees who have been without pay for 14 or more consecutive

days. This is to prevent overlap between the CEWS and the Canada Emergency Response Benefits.

Pre-crisis weekly remuneration is the average weekly remuneration paid between January 1 – March 15, excluding any 7-day period where the employee was not paid.

The premiums you pay to employees on leave can be included in the subsidy calculation.

The subsidy is treated as government assistance and is taxable to the employer in the year received.

Employers must apply through the CRA My Business Account portal. The portal should be online in 3-6 weeks, with payments to follow.

We recommend all employers ensure they are registered with CRA for direct deposit and assemble records so that when the application opens you are ready.

If you receive the CEWS payments for a period you do not qualify for, you will need to repay the amounts to CRA if you do not meet the eligibility criteria.

Any fraudulent claims or abuse of the system will result in a penalty of up to 225% of the CEWS benefits received and up to 5 years in jail time. There is also a shaming provision, where your name will be publicly disclosed – We don’t recommend trying to game it.

The CEWS is nuanced, and clearly proper recordkeeping will need to be kept in case of audit. Our friends at Tax Templates have developed a handy excel worksheet to help calculate the CEWS.

We understand these are challenging times – we are offering consultations to help guide business

owners, please send us an e-mail at info@kpcpa.ca or call us to speak to one of our Partners today.

The Canada Revenue Agency (CRA) has come under renewed scrutiny following a critical 2025 report from the Auditor General of Canada. While taxpayers have long been aware of service challenges at the CRA, this report confirms systemic issues that affect every taxpayer who release on CRA contact centres or online tools for guidance.

Despite the prorogation, the Canada Revenue Agency (“CRA”) has stated it will continue to administer the proposed capital gains inclusion rate increase as if it were law, even though it has not received Royal Assent.

The Government of Canada has announced temporary goods and services tax / harmonized sales tax (“GST/HST”) relief {{view-more}} on children’s clothing, toys, games, books, food and beverages.

Canadian businesses will be required reduce GST/HST to zero on a variety of qualifying products between December 14, 2024, to February 15, 2025. {{view-more-end}}

Capital gains inclusion rate The capital gains inclusion rate will increase from 50% to 66.67% for capital gains realized on…

K&P CPAs, a boutique licensed public accounting and valuations firm based in Toronto, Canada, is pleased to announce its adoption…

Introduction Canada is currently experiencing a significant demographic shift that is reshaping the landscape of wealth distribution: the inter-generational transfer…

Introduction Clients often approach us inquiring about what a business valuation entails. Their interest stems from many situations that include:…

Introduction Business owners often benchmark their businesses against a rule of thumb to identify a preliminary valuation for their business….

Businesses must repay their CEBA loan by January 18, 2024, to be eligible for the forgivable portion of the loan….

Certain trusts, including bare trusts, that were previously not required to file a trust return, will be required to do…

Bare trusts will be required to file a T3 Return, and report beneficial ownership information on Schedule 15. The new…