Guide to the Ontario Business Registry

On October 19th, 2021, the Government of Ontario launched the Ontario Business Registry online service to provide businesses and not-for-profit corporations a 24/7 platform to use to update their registered business information.

Previously, Ontario corporations were required to keep their business information up to date by filing the mandatory Annual Information Return together with their T2 Income Tax Return to the CRA.

After October 19th, 2021, the Annual Information Return must be filed separately from the T2 in the Ontario Business Registry. K&P recommends that you file your own information return directly using the registry, due to the simplicity of the filling and convenient 24/7 access to the online registry.

The Ontario Business Registry offers additional services beyond filing the Annual Information Return. In the registry, you may also access a wide range of government services, including:

It is the responsibility of the corporation to keep its information on the public record and beneficial ownership information accurate and up to date.

Ordinarily, your Annual Information Return is due six months after your fiscal year-end. However, depending on your corporation’s year-end and the timing of your filing, your filing deadlines will vary.

|

Year-end Date |

Annual Information Return Due Date |

Filing Location |

|

January 1 – May 14, 2021 |

Required – Six months after year-end |

CRA, together with your T2 |

|

May 15 – October 18, 2021 |

Exempt – No Annual Information Return required for 2021 |

N/A |

|

October 19 2021 – Present |

Required – Six months after year-end |

Ontario Business Registry |

If your corporation was registered or incorporated before the launch of the Ontario Business Registry on October 19th 2021, then the Ontario Ministry has already created your profile in the registry and migrated any business information you previously submitted to the CRA.

To access your profile in the Ontario Business Registry, please follow these two steps:

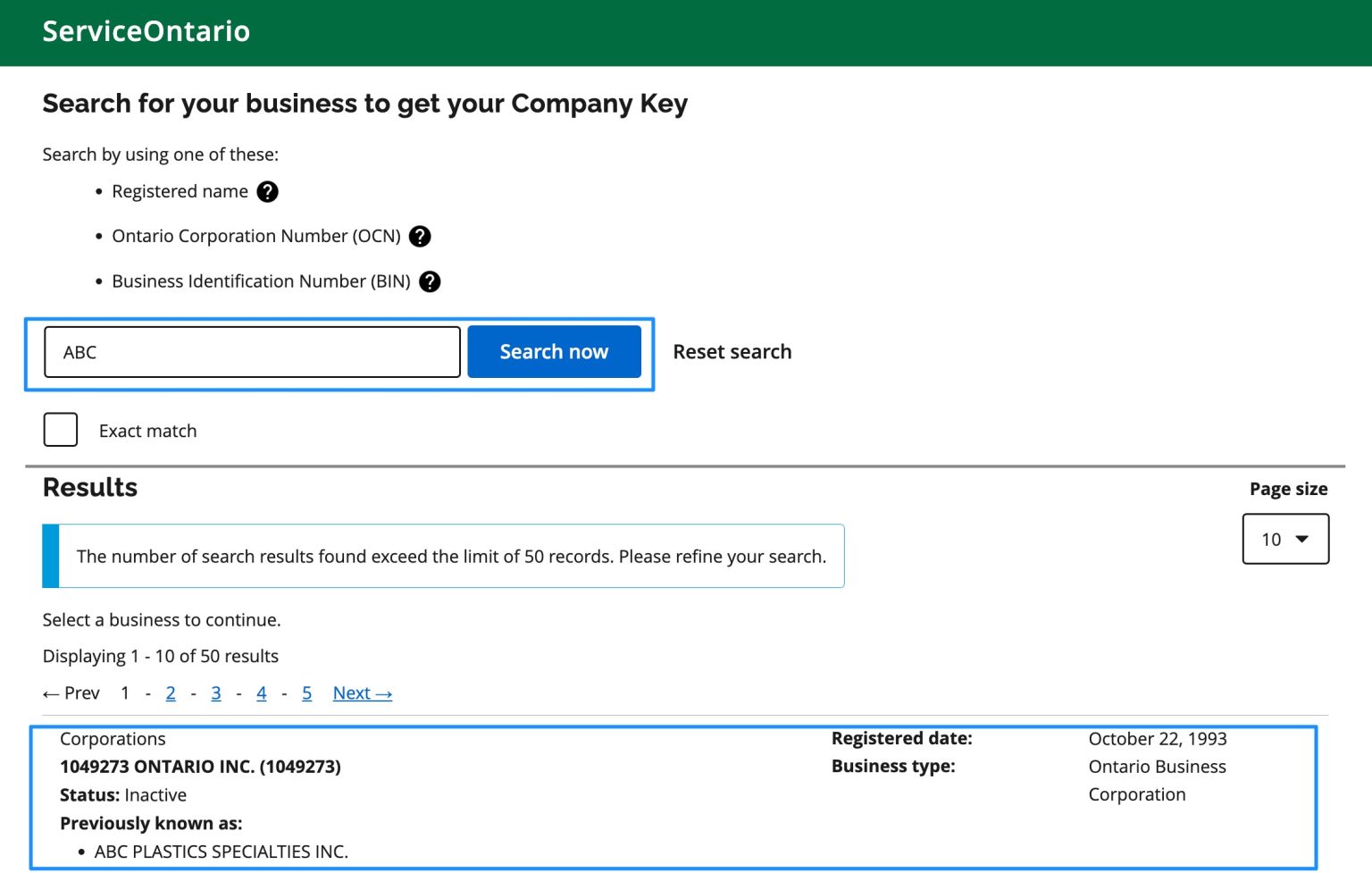

To acquire a Company Key, follow this link to visit Service Ontario’s business search webpage.

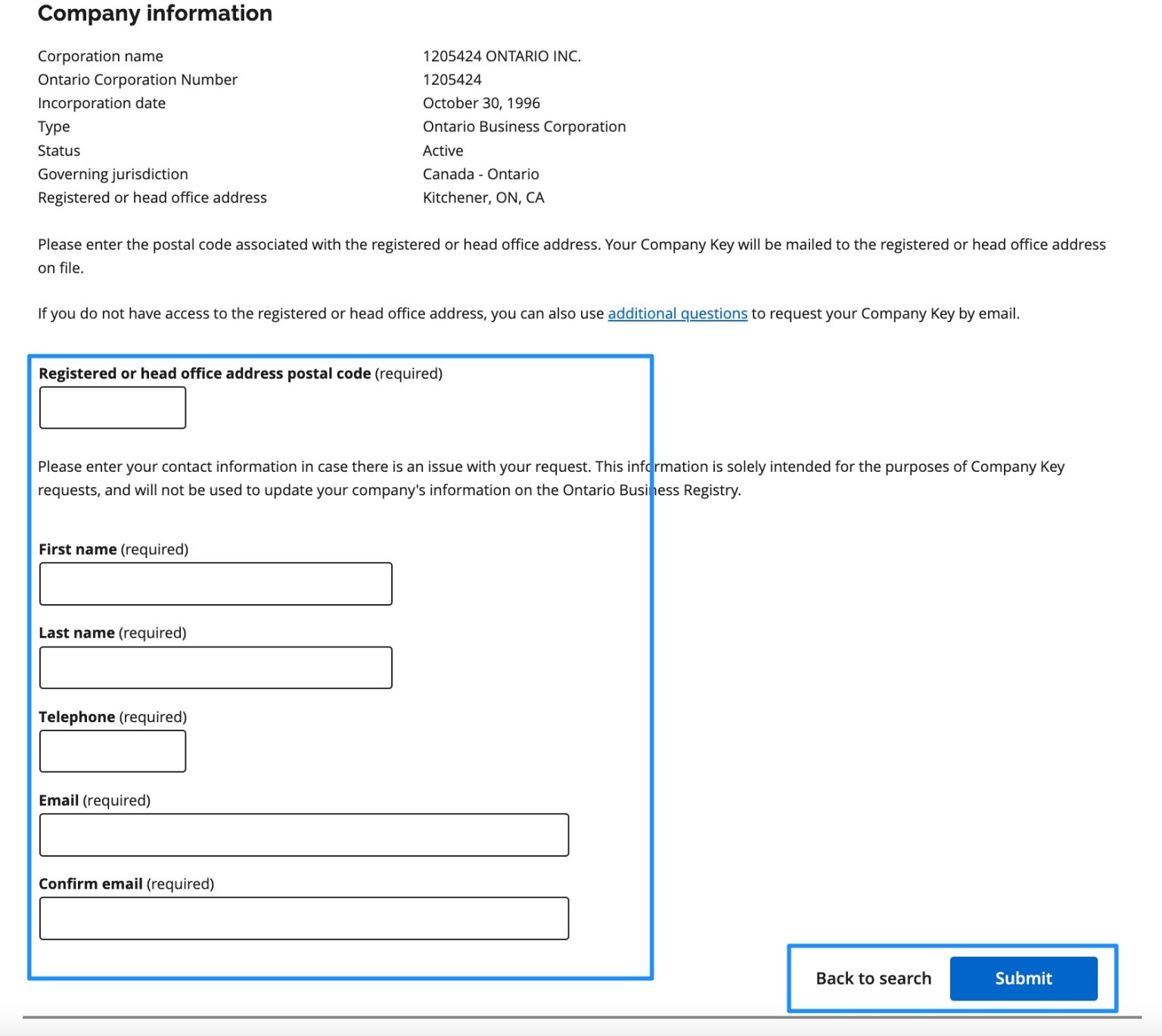

On this webpage, enter your business name in the search bar and select your corporation. Then, provide your corporation’s contact information in the response fields and click “Submit”.

Your Company Key will be sent to the official email address provided in your previous Annual Information Returns. If you do not have an official email address, it will be mailed to your registered or head office address.

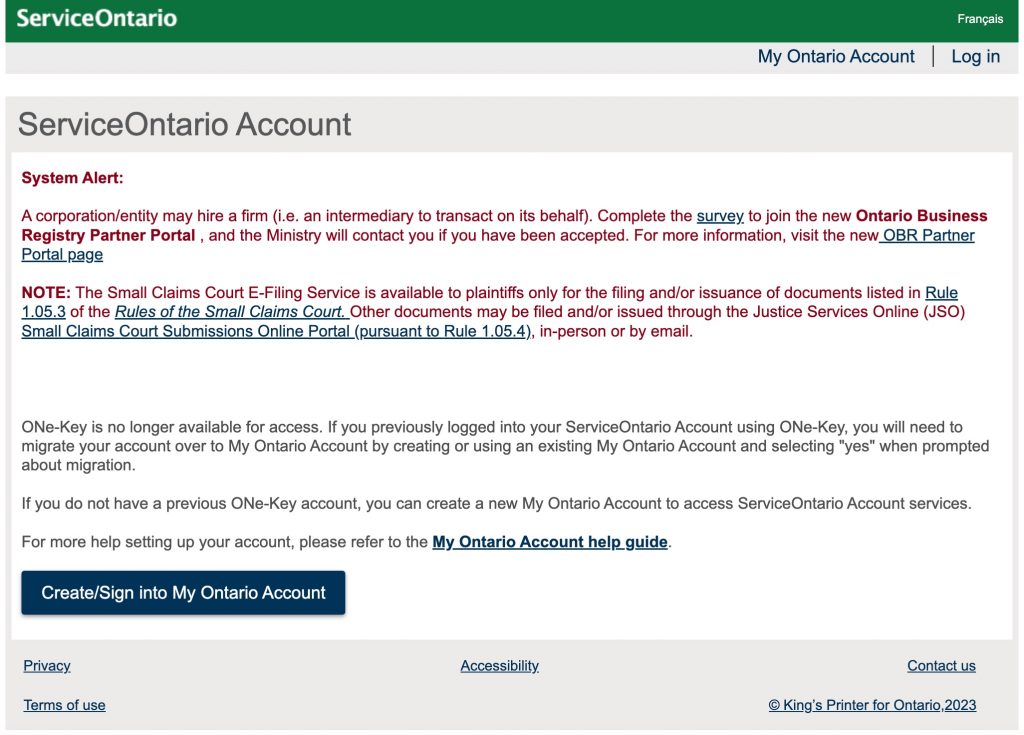

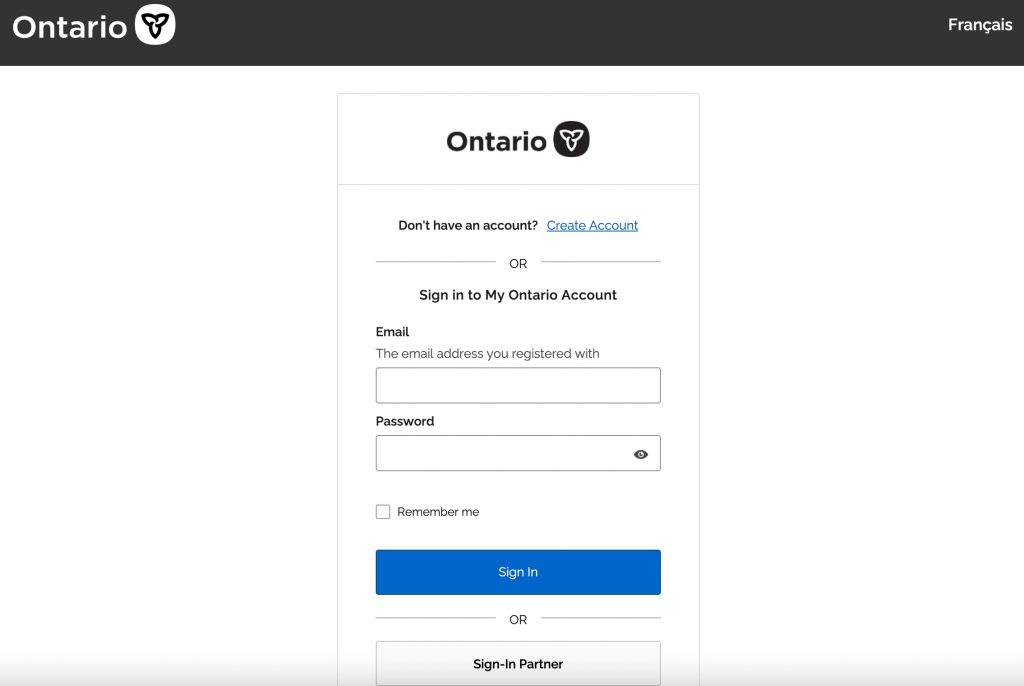

Once you have received your Company Key, follow this link to visit Service Ontario’s login portal.

On this webpage, you are required to create a One-key account. Follow the prompts to create your account, and when instructed, enter your Company Key. Upon entering your Company Key, you will have full access to your profile in the Ontario Business Registry using this same webpage.

The requirement to file the Annual Information Return with the Government of Ontario has become more onerous for the taxpayer. This will require registering for an account with the Ontario Business Registry as well as setting up annual reminders to ensure that you continue to maintain compliance for your corporation.

The K&P CPAs team provides expert assistance in all things finance, including business valuation and financial advisory.

If you have any questions, feel free to contact us for more information.

A concise summary of the 2025 Canadian personal tax changes, including federal tax rate cuts, capital gains updates, AMT, and CPP2 impacts

The Canada Revenue Agency (CRA) has come under renewed scrutiny following a critical 2025 report from the Auditor General of Canada. While taxpayers have long been aware of service challenges at the CRA, this report confirms systemic issues that affect every taxpayer who release on CRA contact centres or online tools for guidance.

Despite the prorogation, the Canada Revenue Agency (“CRA”) has stated it will continue to administer the proposed capital gains inclusion rate increase as if it were law, even though it has not received Royal Assent.

The Government of Canada has announced temporary goods and services tax / harmonized sales tax (“GST/HST”) relief {{view-more}} on children’s clothing, toys, games, books, food and beverages.

Canadian businesses will be required reduce GST/HST to zero on a variety of qualifying products between December 14, 2024, to February 15, 2025. {{view-more-end}}

Capital gains inclusion rate The capital gains inclusion rate will increase from 50% to 66.67% for capital gains realized on…

K&P CPAs, a boutique licensed public accounting and valuations firm based in Toronto, Canada, is pleased to announce its adoption…

Introduction Canada is currently experiencing a significant demographic shift that is reshaping the landscape of wealth distribution: the inter-generational transfer…

Introduction Clients often approach us inquiring about what a business valuation entails. Their interest stems from many situations that include:…

Introduction Business owners often benchmark their businesses against a rule of thumb to identify a preliminary valuation for their business….

Businesses must repay their CEBA loan by January 18, 2024, to be eligible for the forgivable portion of the loan….

Certain trusts, including bare trusts, that were previously not required to file a trust return, will be required to do…